Indian poultry industry has made a remarkable growth ever since its emergence and is arising as a glorious sector with a growth rate of 8.51 and 7.52% in egg and broiler production, respectively. The fastest-growing segment of the global meat demand is poultry meat, and India, the second-largest developing nation in the world, is seeing a rapid expansion of its poultry industry. India is the third-largest producer of eggs and chickens in the world. Now that poultry production is intensifying quickly, there are significant capacity and safety issues.

The Indian Poultry Market was estimated to be valued at INR 1959.5 billion in 2022. The market is anticipated to expand at a CAGR of 8.1% between 2022, aided by the increased demand for diets high in protein, to reach a value of about INR 2,897.6 billion by 2027. Raising birds for their eggs and meat, such as ducks, turkeys, chickens, and geese, for domestic or commercial purposes is referred to as poultry. Proteins and nutrients like zinc, iron, and iodine, among others, which are necessary for the body’s growth and development, can be found in plenty in poultry-based products.

Through channels of distribution like conventional retail stores, business to business, or contemporary retail stores, meat and eggs are made available to the market for use in food services or for individual consumption. Poultry items are now accessible through online retail channels because to the growth of online grocery retailers in India, like Grofers, Amazon Fresh, and Big Basket etc. So, the expanding availability of poultry products is promoting market expansion in India.

Due to increased wages and a greater emphasis on nutritious foods, changing consumer tastes are driving the Indian poultry market. The region’s market for poultry products has grown recently due to the increased focus on physical wellness. In addition, eggs are frequently used as active ingredients in bakery goods, and the market is expanding as a result of the growing demand for cakes and pastries. The adoption of poultry by rural households, which are engaged in supplying meat products and eggs to markets, is another factor contributing to the market expansion. Poultry is a highly vertically integrated industry in India and matches the efficiency levels of many western countries.

The sector has potential as a result of a number of variables, including rising per capita income, an increase in the urban population, and declining real poultry prices. Future expansion of the poultry sector in India will depend on integrated production, the market shift from live birds to chilled and frozen goods, and regulations that guarantee supply of corn and soybeans at reasonable prices. The change from backyard poultry to large-scale commercialization over the years has been steady, with organised commercial farms producing over 70% of chicken output, especially in the broiler category.

In India, farmers have switched from raising country birds in the past to hybrids, which provide better operational conditions and long-term financial success for the poultry producers. Given that consumers prefer live birds, distribution and retailing are still poorly structured despite the fact that production is largely organised.

Poultry Associations in India

There are several poultry associations in India like Poultry Federation of India (PFI), Compound Livestock Feed Manufacturers Association (CLFMA), National Egg Coordination Committee (NECC), Indian National Federation of Animal Health (INFAH), Broiler Coordination Committee (BCC) and likewise. The associations also play an important role by regularly guiding the farmers, creating awareness among consumers and presenting industry requirements to the government, promoting egg consumption on various occasions etc.

Indian Poultry Sector Statistics

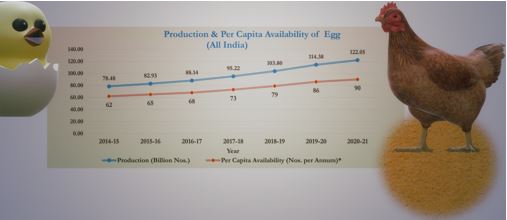

India has the world’s largest population of livestock. As per the Basic animal Husbandry Statistics- 2022.The total egg production in the country is 122.05 billion numbers. India ranks 3rd in the world in terms of total Egg production (Source: FAO). The egg production has increased by 6.70 % as compared to previous year. The per-capita availability of egg is 90 eggs per annum. Top 5 egg producing States are Andhra Pradesh (20.45%), Tamil Nadu (16.49%), Telangana (12.98%), West Bengal (8.60%). Karnataka (6.24% They together contribute 64.77% of total egg production in the country. The total egg production from commercial poultry is 103.29 billion numbers and backyard poultry are 18.75 billion numbers contributing 84.63% and 15.37% of total production of egg respectively. The total meat production in the country is 8.80 million tonnes India ranks 8th in the world in terms of total Meat production (Source: FAO). The meat production has increased by 2.30% as compared to previous year. The meat production from poultry is 4.47 million tonnes, contributing about 50.84% of total meat production. The growth of poultry meat production has decreased by 2.98% over previous year. The top 5 meat producing States are Maharashtra (12.60%), Uttar Pradesh (11.79%) West Bengal (11.30%), Andhra Pradesh (10.84%) and Telangana (10.46%). Poultry sector contributes 57% of total meat production in India. As per APEDA India has exported 320,240.46 MT of Poultry products to the world for the worth of Rs. 529.81 Crores/ 71.04 USD Millions during the year 2021-22.

Challenges to Poultry Industry

- The future expansion of the poultry business is hampered by a number of reasons, including poultry immunity, health, and productivity.

- Major obstacles to the current state of the sector and its strategic future will continue to be consumer confidence, product quality and safety, product types, and the introduction and re-emergence of diseases.

- Poultry is inextricably related to zoonotic and foodborne diseases. Foodborne and zoonotic pathogen eradication, elimination, and/or management provide a significant challenge to the poultry business.

- The risks to the general public’s health from eating foods with significant antibiotic residues will also continue to be a major problem. It is crucial to understand that hens are not vulnerable to intranasal SARS-CoV-2 (COVID-19) viral infection. Nevertheless, the COVID-19 pandemic makes an impact on poultry farming’s finances, transportation, and consumption. Along with these factors, it will consider the maintenance of high environmental security as well as economic, ethical, and social aspects.

- Raw material shortage is a further problem. Because of the rising cost of soybean meal, feed producers were obliged to make dietary concessions for birds.

- Another issue is a lack of human resources because there aren’t enough researchers or veterinarians in the fields where their knowledge is needed.

- The Indian poultry industry is still unable to take advantage of the global market. The main issue hurting the poultry industry in India is the lack of sufficient cold storage and warehouses. The unorganised sector produces the vast majority of the product as backyard poultry for extra revenue.

- Increasing the amount of antibiotics in poultry products has detrimental long-term effects, such as the development of drug resistance in humans. Lack of thorough regulatory authority to uphold hygiene and the licencing of businesses.

- India’s per capita consumption is lower than that of other nations. With increased demand and the imposition of a minimum support price, the poultry industry’s expansion can be maintained.

Conclusion

The continued expansion of the poultry industry may be hampered by issues with organic matter transportation, waste management, the use of green energy, disease diagnostics, and other issues. For the industry to meet consumer demand and ensure sustainable agriculture, shareholders, veterinarians, farmers, and all other stakeholders in the chain of poultry production need to be more involved in the current state for the industry’s strategic future. The necessary policy actions for the poultry industry must include enhancing infrastructure facilities, which will help stabilise the price of poultry products on the domestic market and make them accessible in remote areas Developing an effective marketing channel that will help producers receive fair prices and increasing the availability of poultry products in remote areas.

Anuj Kumar1*, Amit Kumar2, D K Singh3 and Ahmad Fahim4

1Ph.D. Research Scholar, 2Professor and Head, 3Professor, 4Assistant Professor, Department of Livestock Production Management, College of Veterinary and Animal Sciences, Sardar Vallabhbhai Patel University of Agriculture and Technology, Meerut, 250 110, India

Corresponding author:

Email- *drvetanuj@gmail.com