India is one of the world’s largest and fastest-growing economies. With the current population of 1.33 billion we are expected to reach 1.65 billion and surpass China by 2050. 71% of Indians over the age of 15 are non-vegetarian. To address the nutritional security we have a high requirement of protein to feed the vegetarian and non-vegetarian population.

Growth in per capita income and increasing disposable income is shifting consumer preferences from cereals to fruits, vegetables, dairy, and meat. Rapid urbanization has further accelerated the demand of processed poultry and meat in urban areas.

According to the OECD-FAO Agricultural Outlook 2030, poultry meat is expected to represent 41% of all protein from meat sources globally. Poultry meat and eggs are the fastest-growing food segments in India and the per capita chicken consumption is expected to grow from 3.2 to 9.1 Kg the share of poultry & other meat in household food consumption is expected to grow from 12 % to 24% by 2030.

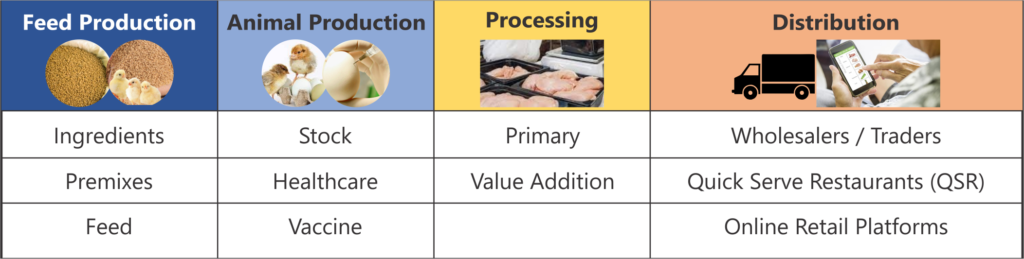

India’s food processing industry is one of the world’s largest, with production anticipated to reach $535 billion by 2025-26. India is a hotbed of opportunities across the complete value chain of the poultry sector.

India has one of the highest feed cost per kg of broiler and opportunities exist right from crop production to feed formulation and production for optimum nutrition. The animal feed market has a market potential of $6 bn by 2025. Compound feed has a market potential of $400 – 650 mn with 16% growth over the next 5 years with potential capacity addition of 10-18 MMT. The major growth drivers are low organic feed market, penetration, increasing formal offtake, etc. Feed manufacturing potential has an Internal Rate of Return (IRR) of 17-20% and payback within 9-12 years.

With burgeoning demand, the production needs to grow at the same pace. The Indian animal healthcare industry accounts for 2.5% of the global animal healthcare industry and is expected to grow @6% CAGR. Animal Vaccines comprise 17% ($170 mn) of the overall Animal Healthcare industry in India, which stands at $ 950 mn. Indian poultry market, consisting of broilers and eggs was worth $25B in 2018 and is projected to reach $60B by 2024, growing at a CAGR of ~16%. India ranks 3rd in Egg Production in the world with 122.04 billion poultry eggs produced in 2020-21.

The emergence of vertically integrated poultry producers that have reduced consumer prices by lowering production and marketing costs and the market is transitioning from live birds to chilled and frozen products. Barely 5% of eggs produced are processed into dehydrated/frozen products.

Poultry processing & value addition are still at a very nascent stage but both the quantity and value of the exported processed poultry products have increased during the last few years. Despite being 3rd biggest poultry producer more than 90% of chicken is unprocessed (live chicken). Though, the trend is changing rapidly with the processed chicken market is expanding at 15% CAGR with rising of QSRs (Quick Service Restaurants like KFCs) and online meat delivery platforms (Licious, Zappfresh, Bigbasket, Grofers, etc.).

The biggest opportunity lies in this budding consumer brands segment. There exists a gap in the value chain as most of these vendors lack dry processing, storage, cold chain facilities and logistical (refrigerated trucks or specialized equipment) for packing and transporting produce.

Compliance with food safety norms is essential for consistent growth in demand and coupled with creating awareness about processed products will promote the consumption of healthy, safe, and hygienic meat products win customer confidence.

With increasing development in the food retail sector, favorable economic policies, and attractive fiscal incentives, India’s food ecosystem provides tremendous business prospects to investors. The poultry industry needs capital investment and state-of-the-art technology in its operations to bring in greater efficiency in supply chain management and business processes.

The Ministry of Food Processing Industries (MoFPI) making impressive efforts to attract investment across the national and global food processing value chains.

Government norms permit 100% foreign investment through an automatic route for Animal husbandry (poultry, fish farming, aquaculture under controlled conditions) and agriculture for trading, including through e-commerce, in respect of food products manufactured and/ or produced in India. 100% FDI is permitted through an automatic route for food processing as well.

In 2020-21, the food processing industry saw FDI inflows amounting to$ 393.41 million, and from April 2000 to November 2021, the food processing sector received a total of US$ 10.88 billion in FDI.

At the end of the day, the most significant reason to invest in the sector is the ever-increasing demand and profitability of the food processing sector.

By:- Ms. Siddhi Gupta

Co-Editor

Pixie Consulting Solutions Limited